|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pet Insurance Companies in America: Navigating the World of Furry CoverageIn recent years, pet insurance has become an increasingly popular consideration for American pet owners who seek to safeguard their beloved companions against unforeseen veterinary expenses. This burgeoning market is a reflection of a growing recognition of pets as integral family members, warranting protection and care comparable to that of human health insurance. The landscape of pet insurance companies in America is both vast and varied, offering a plethora of options that cater to the diverse needs of pet owners. From comprehensive policies covering a wide range of ailments to basic accident-only plans, the choices are abundant and can sometimes feel overwhelming. Among the most prominent players in this arena are companies such as Nationwide, Trupanion, and Healthy Paws, each bringing distinct offerings to the table. Nationwide, for instance, is renowned for its extensive coverage options, which span from routine wellness checks to more serious health conditions, making it a robust choice for those seeking peace of mind. On the other hand, Trupanion is lauded for its straightforward approach to claims, providing a seamless experience that reduces the administrative burden often associated with insurance processes. Healthy Paws, meanwhile, distinguishes itself with its charitable initiatives, donating a portion of every sale to homeless pet care, which appeals to the ethically conscious consumer. While the merits of pet insurance are evident, navigating the myriad options requires careful consideration. Pet owners are advised to evaluate factors such as coverage limits, exclusions, deductibles, and reimbursement models. It is essential to scrutinize the fine print, as certain conditions may not be covered, or there may be waiting periods before the policy takes effect. A common best practice is to obtain quotes from multiple providers and compare them not just on price, but on the comprehensiveness of coverage and the company's reputation for customer service. Moreover, the decision to invest in pet insurance should be informed by the specific needs of the pet. Breeds prone to certain genetic conditions, for example, might benefit from more comprehensive coverage, whereas a younger, healthy pet might only require a basic plan. It's also worth noting that some companies offer discounts for insuring multiple pets, which can be a boon for households with several furry members. Ultimately, the choice of a pet insurance provider is a personal one, reflecting the values, financial situation, and risk tolerance of the pet owner. As the industry continues to evolve, with new players entering the market and existing ones expanding their offerings, it remains crucial for consumers to stay informed and vigilant. After all, the ultimate goal is to ensure that our pets receive the best possible care without undue financial strain. FAQ Section What does pet insurance typically cover? Pet insurance generally covers unexpected veterinary costs due to accidents or illnesses. Some policies may also include wellness care such as vaccinations, routine check-ups, and preventive treatments, though these are often available at an additional cost. Is pet insurance worth it for older pets? While premiums may be higher for older pets, insurance can still be worthwhile as the likelihood of health issues increases with age. It is important to carefully review the policy terms to ensure that chronic and pre-existing conditions are adequately covered. How are pet insurance claims processed? Typically, pet owners pay the vet directly and then file a claim with their insurance provider for reimbursement. The claim process varies by company, with some offering direct vet payments, thereby minimizing out-of-pocket expenses at the time of treatment. Are there any exclusions in pet insurance policies? Yes, most pet insurance policies have exclusions, such as pre-existing conditions, elective procedures, and certain hereditary conditions. It is crucial to review the policy details to understand these exclusions before purchasing. https://www.trupanion.com/

Trupanion policies are underwritten by American Pet Insurance Company or ZPIC Insurance Company in the United States, and sold and administered by Trupanion ... https://www.akcpetinsurance.com/

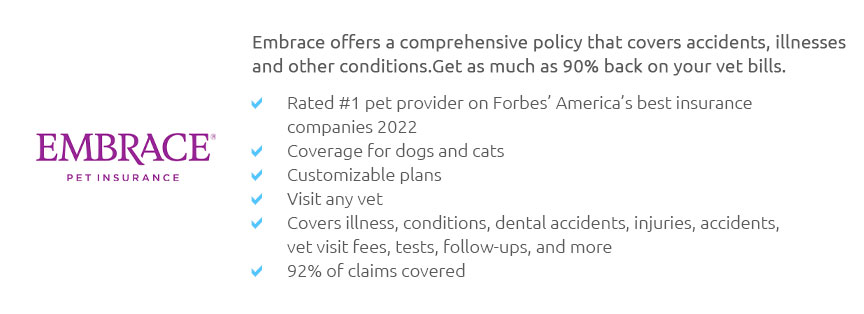

AKC Pet Insurance offers pet insurance to both cats and dogs of all ages and breeds. Get a free quote from our calculator today or call us at 866-725-2747. https://www.embracepetinsurance.com/

Pet insurance from Embrace saves you up to 90% back on vet bills from unexpected illness and medical expenses. From dog and cat insurance to wellness ...

|